I’ve sat in insurance call centers where the air feels heavy.

Not dramatic. Just… tired.

Agents juggling five screens. Customers repeating their policy number for the third time. Claims stuck in limbo because a single field was typed wrong two departments ago. Everyone is working hard. The system is still failing them.

And then leadership says: “We should add AI.”

That’s the moment skepticism walks into the room.

Because insurance doesn’t have a technology problem. It has a communication bottleneck. Claims. Policy updates. Status checks. Coverage questions. Endless Customer Calls that are repetitive, sensitive, and emotionally loaded.

This is where AI voice agents for insurance stop being a shiny idea and start becoming operational infrastructure.

Not to replace humans.

To protect them from drowning.

The Real ROI of Voice AI in Claims Handling

Let me be blunt: most insurance operations are built on heroics. People compensate for broken workflows with pure effort.

That doesn’t scale.

AI voice agents plug into the exact fracture points, claims intake, policy servicing, verification, and follow-ups and remove the friction customers feel immediately.

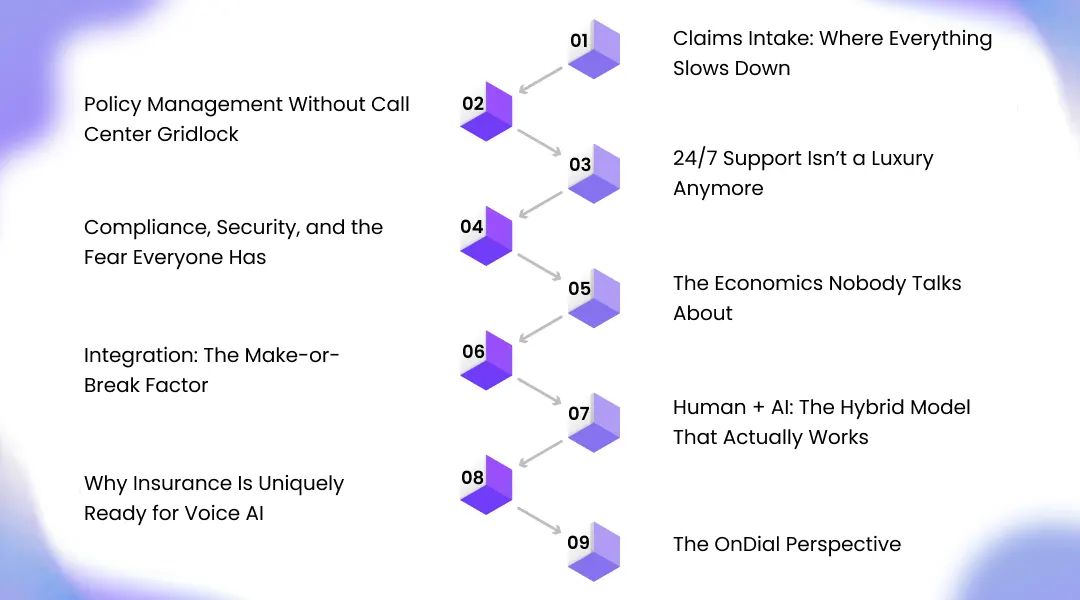

Claims Intake: Where Everything Slows Down

A claim is rarely just data. It’s stress. Accidents. Medical events. Financial fear.

When someone calls, they don’t want a menu maze. They want clarity.

An AI voice assistant for insurance handles first-contact claims intake instantly. No queue. No hold music. Structured data capture that doesn’t miss fields. It asks the same compliance-safe questions every time. Perfectly. At 3am. On a holiday.

Here’s the operational shift:

- AI claims processing insurance begins at the first interaction

- Information flows directly into the claims system

- Human adjusters receive clean, structured cases

- No re-keying. No transcription errors

I’ve seen processing time drop not by 5%. By hours per case. Multiply that across thousands of claims.

That’s not optimization.

That’s survival math.

Policy Management Without Call Center Gridlock

Policy servicing is the silent killer of insurance contact centers.

Address changes. Coverage checks. Renewal questions. Payment confirmations. These aren’t complex. They’re volume.

Insurance call center automation works best when you respect that 60–70% of inbound traffic is predictable. Repetitive. Automatable.

A conversational AI insurance system handles:

- Policy status inquiries

- Premium reminders

- Coverage explanations

- Basic endorsements

- Renewal confirmations

Customers talk naturally. No scripts. The voice bot for insurance providers understands intent, retrieves policy data, and responds in seconds.

Let me ask you something uncomfortable:

How much of your call volume actually requires a licensed expert?

Exactly.

When AI insurance customer experience systems absorb routine traffic, human agents finally do the work they were hired for: complex cases, empathy, negotiation, judgment.

The call center doesn’t shrink.

It matures.

24/7 Support Isn’t a Luxury Anymore

Insurance events don’t wait for business hours. Accidents happen at night. Flights get canceled at 4am. Hospitals don’t close.

A 24/7 insurance voice support system isn’t about convenience. It’s about credibility.

When policyholders reach you instantly, trust compounds. When they wait 45 minutes, resentment compounds.

Automated insurance voice agents respond instantly, triage urgency, and escalate when needed. No dead air. No “please call back later.”

Speed is emotional.

People remember how fast help arrived.

Compliance, Security, and the Fear Everyone Has

Let’s address the elephant.

“Is AI safe for insurance data?”

Good. You should be paranoid.

Insurance operates inside regulatory guardrails for a reason. AI insurance contact center systems must follow the same rules as human agents: encryption, audit trails, access controls, and consent logging.

The difference is consistency.

Humans forget scripts. AI doesn’t.

An intelligent claims management system documents every interaction automatically. Timestamped. Searchable. Reviewable. That level of traceability is a compliance officer’s dream.

I’ve worked with regulated industries long enough to say this confidently: well-built AI is often more auditable than human operations.

Not less.

The Economics Nobody Talks About

Executives love ROI slides. But the real math isn’t just cost reduction.

It’s volatility.

AI-driven insurance operations stabilize workload spikes. Natural disasters. Seasonal surges. Marketing campaigns that accidentally work too well.

A virtual agent for insurance companies scales instantly without hiring freezes or emergency outsourcing. That stability protects margins and agent morale at the same time.

And morale matters.

Burned-out call centers bleed talent. Talent loss bleeds institutional knowledge. Knowledge loss bleeds customer trust.

Technology isn’t replacing people here.

It’s preventing collapse.

Integration: The Make-or-Break Factor

Here’s where most AI projects die.

Not in strategy. In plumbing.

If your automated policy support system doesn’t talk to your CRM, claims engine, and telephony stack, it becomes a glorified demo.

Real insurance workflow automation means:

- Live API connections to core systems

- Secure identity verification

- Context retention across channels

- Clean handoffs to humans

This is why choosing the Best AI Voice Agent Platform isn’t about features. It’s about architecture discipline. Insurance tech stacks are messy. Legacy-heavy. Politically sensitive.

Implementation partners matter more than software brochures.

(I’ve seen million-dollar tools fail because integration was treated like an afterthought.)

Human + AI: The Hybrid Model That Actually Works

The fantasy version of AI says: full automation.

Reality says: hybrid intelligence wins.

AI handles the predictable. Humans handle the nuanced.

When you Hire AI Voice Agents correctly, you’re not replacing your workforce. You’re redesigning job roles around judgment instead of repetition.

Agents become specialists instead of script readers.

Customers feel heard instead of processed.

That’s the future of AI in insurance customer service. Quiet. Practical. Invisible when it works well.

Which is the highest compliment technology can earn.

Why Insurance Is Uniquely Ready for Voice AI

Insurance runs on structured conversations.

Verification. Documentation. Clarification. Confirmation.

Voice AI thrives in environments where dialogue follows patterns. And insurance is full of patterns. Claims scripts. Policy disclosures. Regulatory statements.

A Best Voice Assistant built for insurance understands domain language: deductibles, riders, exclusions, endorsements. It doesn’t panic when terminology gets dense.

That domain training is what separates toy demos from enterprise systems.

And enterprises don’t buy toys.

The OnDial Perspective

I respect vendors who admit limitations. That’s rare.

OnDial approaches AI-powered insurance support like infrastructure, not marketing theater. Their focus on human-centric design and transparent implementation is what insurance teams actually need: predictability.

Voice AI projects fail when expectations are fantasy-driven. They succeed when goals are operational: reduce queue time, increase first-call resolution, standardize claims intake.

Boring goals.

Profitable goals.

When an AI partner behaves like a systems engineer instead of a hype machine, adoption becomes smoother. Stakeholders relax. Compliance teams cooperate. CX teams participate instead of resist.

That’s how transformation sticks.

Conclusion

Insurance doesn’t need louder technology.

It needs calmer systems.

AI voice agents for insurance bring order to chaos that’s been normalized for decades. Faster claims. Cleaner data. Available support. Happier agents. Less friction everywhere.

Not magic.

Just disciplined automation applied where humans were never meant to carry infinite volume.

The companies that understand this early won’t look futuristic. They’ll look reliable. And in insurance, reliability is the strongest brand strategy that exists.

Everything else is noise.